Anticipatory Accountants in the Age of Digitalization

The rapid developments in technologies like Big Data, data automation, artificial intelligence, blockchain, cloud computing and audit data analytics are ushering what experts call as “4th Industrial Revolution” and others call it “the Transformation Economy”. The trends in these technologies are pressurising today’s accountants to move away from a “legacy thinking “to an “anticipatory thinking”, as they need to harness the current technological tools to read the future.

The concept of anticipatory thinking is the ability or skill to anticipate the future. It is considered a business model and an innovative way of thinking the future. Therefore, the main additional skill an accountant needs to possess is how to read or predict the future i.e., how to become ‘anticipatory accountant’ in the age of digitalization. Daniel Burrus states that

“professional accountants had the opportunity to discover a new set of skills. They learned how to read the future, avert the consequences of their behaviours, and create organizational cultures geared for the inconceivable. These skills form the model of the “anticipatory accountant”.

In 2015, The American Institute of Certified Accountants’ (AICPA) tech subsidiary issued a report in which Certified Public Accountants (CPAs) were questioned whether they were future ready in the light of changing technologies. The report defined future ready as, “the capacity to be aware, predictive, and adaptive of emerging challenges, tech innovations, and trends and changes in business, population, and social environment.”

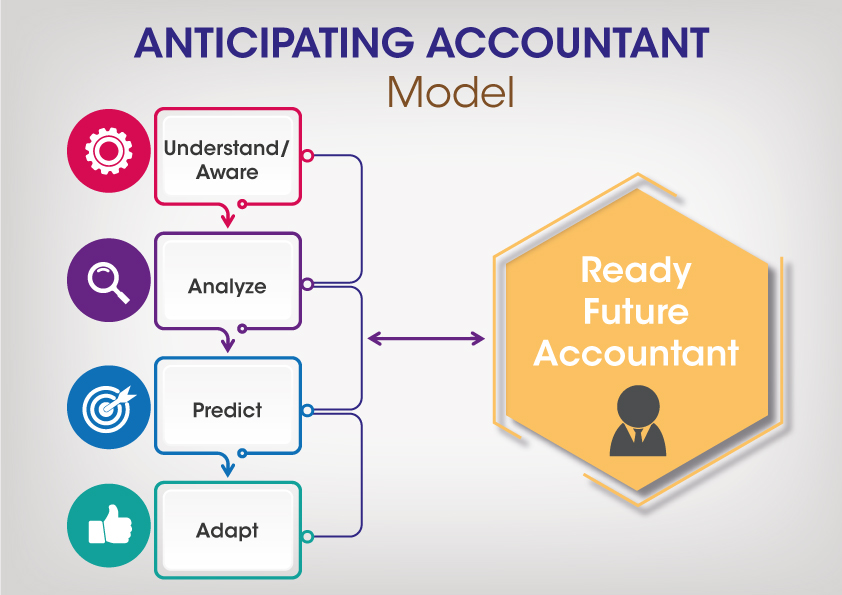

Therefore, the accountants are highly encouraged to possess this anticipatory skills to read future which will empower them in building their profession’s image and reputation. The public trust in them will further increase. The communication of anticipatory accountants will increase through accounting reports and stakeholders will understand where the firm is sustainable and what role the staff can play in it? Today, accountants are compelled to think about the consequences and impact of these trending technologies on their work and profession and whether they are ready to handle it. Figure -1 depicts that scenario.

Figure 1

The elements in the model are further explained below:

Aware & Understand

The anticipatory accountants should be aware that in near future they will use increasingly sophisticated and smart technologies in order to enhance or replace their traditional ways of working . They need to identify the hard trends which will likely impact their ways of working. They should understand that the greater use of social media via smart technology will improve collaboration, disclosure, engagement with stakeholders and their greater accountability.

Analyse

Anticipatory accountants should be able to use their skills meticulously to analyse business data and information needs by using Business Analytics, Big Data Analytics and Audit Data Analytics for prediction and forecast as well as for internal decision making.

Predict

Anticipatory accountants should be able to predict about technology trends, government regulations, demographics, risk issues, going concern issues of their clients, opportunities and timing of fraud commission, business growth and profitability, cash flows, tax structure and tax flow for government, financing needs, business mergers, collaborations, stakeholders expectations, social and environmental considerations etc.

Adapt

Anticipatory accountants should initiate change and be adaptive of emerging technologies, and trends in business, demographics, and the social environment impacting their organization and industry. They should be adaptive in the use of analytics for business data.

Figure-2 : Conceptual Model for “Anticipatory Accountant”

Conclusion:

The concept of anticipatory accountant is not a rocket science rather a common sense approach that tells all professional accountants that they need to learn if they want to stay relevant in society in the era of trending technologies which is affecting them and their profession deeply. Therefore, in the light of rapid changes that are taking place in the technologies, accounting and auditing fields are likely to change fast. The professional accountants urgently need to update and upgrade their skills as well as change their mind set. They should not be engaged in post-mortem of business transactions rather should be pre-mortem. It is claimed that those accountants who are aware and understandable , analyser, predictive, and adaptive may lead the charge for success in the firms of tomorrow and they stay ahead. They will be proactive and not reactive. Anticipatory accountants will promote integrity and objectivity in their approaches. Hence, anticipatory accountants are the needs of the future.

Prem Lal Joshi is a professor in the Faculty of Management, Multimedia University, Cyberjaya, Malaysia. He is a former Professor of Accounting in the University of Bahrain. He is also a Honorary Editor for International Journal of Accounting Auditing and Performance Evaluation, (IJAAPE), U.K, Managing Editor for Afro Asian Journal of Finance and Accounting: An International Journal, (AAJFA), U.K., and Associate Editor for International Journal of Finance and Accounting Studies (IJFAS), Australia.